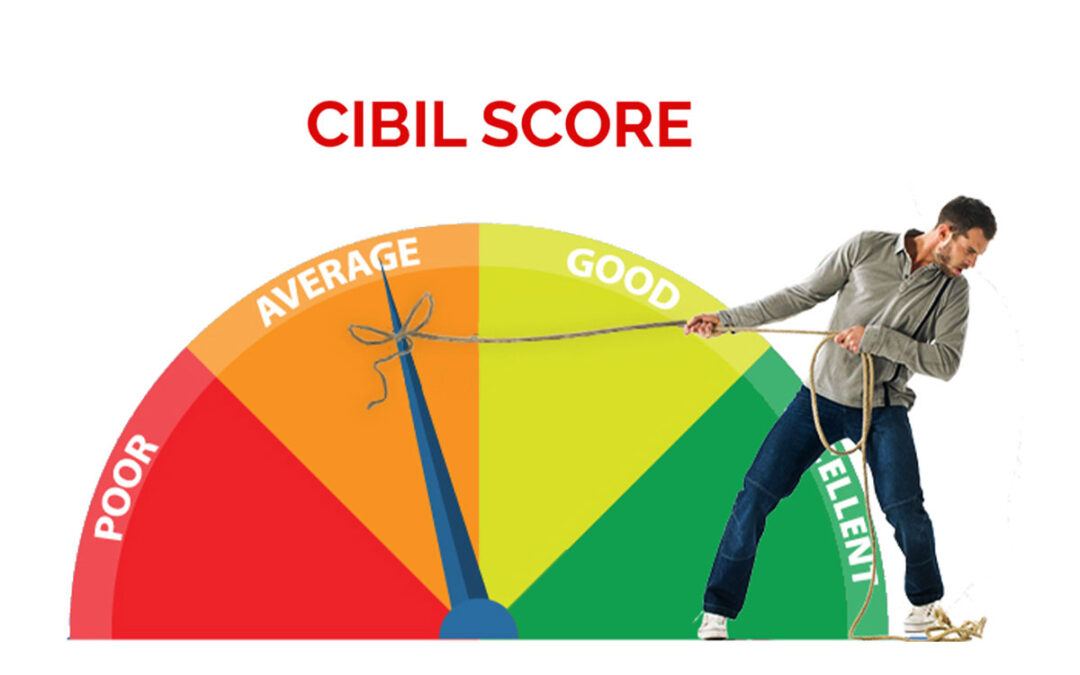

Top 5 tips to improve your CIBIL score

CIBIL score is something to really take care of because you never know when you need to apply for a loan. Perhaps, your children need to apply for their higher studies, or you might be planning to buy a house. If you take things with proper accountability and make informed choices, you are good to go. We have listed down 6 tips that we think might be of help to you to improve your cibil score.

Pay your credit card dues on time to improve your cibil score

Always make sure to repay your credit card dues on time. If you cannot pay the full due, at least pay the minimum amount that is mentioned in your credit card statement. This will not only save you from late payment fees, but also help maintain and improve your cibil score rating.

Needless to say, cut down your credit card expenses if you feel that you might face problems paying a particular expense.

Understand the basics of proper credit utilization to improve your cibil score

The credit approved for you is on the basis of your repayment capacity. If you utilize your full credit limit consistently, it reflects badly on your credit rating. The best way to maintain a good CIBIL is by utilizing a little over 30% of the credit card limit and paying the dues on time.

You can improve your cibil score further by increasing the card limit to make bigger purchases and pay on time. Also, it is detrimental to apply for multiple credit cards and loans.

Keep a check on your credit score

As CIBIL and such credit rating agencies are third party organizations, which depend on the data shared by the banks and other financial institutions, there is a good chance that errors creep in the rating. A lot of customers have reported errors in their credit score at some point in time.

When you are aiming to improve your cibil score, it is best to check the CIBIL score periodically and report any anomalies that are found. Having said that, checking your CIBIL score frequently can adversely affect your rating, as it means that you are a frequent credit seeker.

Build a good credit history to improve your credit score

You can build up a good credit score over time by applying for different types of loans and paying them back on time. A good history of paying back all the dues on time is a factor that every credit companies look at closely while sanctioning new credit.

By different types of loans, we mean long and short-term loans, unsecured and secured loans. If a particular loan was not paid on time due to some unavoidable reasons, and that had affected your credit score, the above strategy will help you correct your credit score.

Avoid multiple loans on multiple PAN cards if you want to improve your credit score

It is evident that when we need capital, we tend to find ways to get more capital from banks, micro-finance institutions and NBFCs. We may present multiple PAN cards of family members to get multiple loans.

This is a very dangerous intention because it is very likely that you won’t be able to pay back the loans, and you will fall under a debt trap. It will become very difficult to improve your credit history and CIBIL score from thereon.

About Protech Group:

We at Protech make constant endeavors to help build better properties in both the residential and commercial sectors in Guwahati.

If you too are looking for commercial and residential properties in Guwahati, Assam, Protech Group is your solution. Our years of experience in the real estate industry and understanding of the market allow us to introduce you to the best in the city.

To know more, you can connect with our experts today by clicking here. We also hope that you enjoyed this read. Don’t forget to check out our blog again soon.